Marginal Gain Theory

To date 165 organisations of all shapes and sizes, across 14 different industries, on four different continents, from very big to very small, so far have combined Telemetry RT3 and Marginal Gain Theory and increased their annual revenues by an average of 24% year-on-year.

The concepts of data analysis and marginal gains have already combined to revolutionise many sports around the world in the last decade or so. Athletics, baseball, every code of football, basketball, hockey, tennis, golf, swimming. In fact it's hard to think of one that hasn't been transformed in some way by marginal gains.

Most people familiar with the terms "marginal gains" or "marginal improvements" or even "one percenters", usually associate them with Sir David Brailsford who when he famously took over as the performance director of British Cycling in 2003, went about breaking down the objective of winning bike races in its smallest component parts. The results he achieved at both the Olympic Games and Tour de France between 2004 and 2016 are now legendary well beyond the relatively narrow confines of international cycling.

By the time David Brailsford and his marginal gain-powered cyclists were smashing their way to eight gold medals and four new Olympic records at the Beijing Olympics in 2008, RevenueTEK was experimenting with the application of what we labelled at the time Marginal Gain Theory, to breaking down not cycling - but revenue production, into its component pieces.

Sir David Brailsford

"Marginal gains

just might

change our world."

The Marginal Gain Equation for Sales

Business leaders frequently overestimate the importance of one defining moment and underestimate the value of making better decisions on a daily basis. Almost every habit that we have — good or bad — is the result of many small decisions over time.

How easily we forget this when we want to make changes. So often we convince ourselves that we can and should be like Steve Jobs – that change is only meaningful if there is some large, immediately visible outcome associated with it. Whether it is losing weight, building a business, or making a sale, we often put pressure on ourselves and our people to make some earth-shattering improvement that will change our world for the better as if in a single instant.

Meanwhile, improving by just 1 percent isn’t notable - it isn’t even noticeable. In fact it’s frequently plain boring - and therefore it’s more than often completely overlooked. But it can be just as meaningful and powerful. It also comes with way less risk – and cost

Unfortunately, the same pattern also works in reverse. When you find yourself stuck with bad habits or poor results, it’s usually not because something happened overnight. It’s the sum of many small poor choices — a 1 percent decline here and there — made over time, that eventually appears as a major problem.

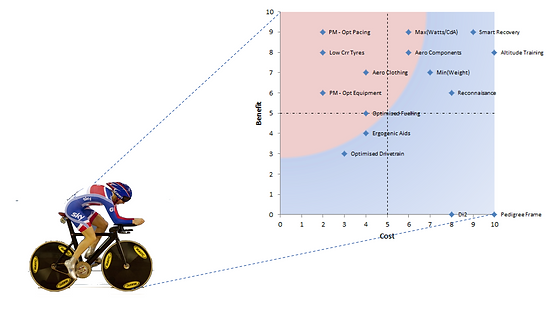

This graphic illustrates what a spectrum of marginal gain opportunities ranked according to cost vs benefit for a professional cyclist in David Brailsford's British team looked like.

And this one describes what a typical Telemetry RT3 diagnostic analysis produces, prioritising all the individual marginal revenue gain opportunities employing a three dimensions ranking system comparing (1) risk; (2) cost; and (3) revenue impact.

The organisation in this particular case study saw their revenue increase by 38% over the following two years, and their profitability by more than 300%.

The transformative power of marginal gains.

The average revenue pipeline converts 34% of leads into opportunities, 33% of those opportunities into offers and 17% of those offers into completed sales - for an end-to-end conversion of 34% x 33% x 17% = 2%. It also takes the average sale 171 days to traverse that full journey through the pipeline.

The combined power of marginal gain theory and pipeline compounding is such that for a company operating at the global 2019 pipeline conversion benchmark, 1% improvements at each of those three key pipeline stages will deliver an increase in total revenue output of 12%. For companies operating under the global benchmark, the quantum overall improvement from those marginal gains ratchets quickly upwards.

This short video immediately below illustrates the power of this incremental yet transformative formula using a real life case study from one RevenueTEK client.

A powerful formula for doubling or trebling profit and valuation - at virtually zero cost.

Profit is the ultimate goal of business, so while making more sales is nice, it's really more profit that we're after in the end. And the two don't necessarily always go together. We've all seen plenty of instances of companies that have literally grown broke. So yes, more sales is what we want - but more profitable sales.

There really are only two routes to increasing profits; more sales or less costs - or both, but that's a pretty hard combination to pull off. Either sell more from the same cost base, or sell the same or even less from a lower cost base. Conventional wisdom and accepted business practice together with almost every business degree and MBA program will tell you that if faced with an immediate and perhaps urgent challenge to increase profits, the strategy of choice should be to attack costs - aggressively. Plenty of consultants and business gurus down through the years have grown very wealthy by preaching and doing exactly that. As often as not resulting in the destruction of the companies they sought to help in the first place, but that's a story for another day.

While it's certainly tempting to simply start slashing costs - and sometimes let's face it, you just have to, there are some associated problems and side-effects that the accountants who often oversee these programs don't always think deeply enough about. When all you have is a hammer, everything tends to look a nail.

The first is that while an organization's profit will almost certainly increase, its profitability almost certainly will not. Unless there's a lot of excess fat in the business, it's almost impossible to reduce costs without harming the organization's ability to sell and deliver. Cost reduction programs frequently go beyond the fat and end up cutting into the muscle and even the bones of a business, compromising its performance and sometimes counter-intuitively, increasing rather than decreasing, the risks of failure.

The second problem is cost reduction isn't sustainable. So yes, assuming a company can reduce it's costs faster than it's sales are dropping, there will certainly be a profit bump. But that will almost certainly be a temporary phenomenon - a one trick pony, because while you can take costs out, you can usually only take them out once. It's very difficult to repeat cost reduction year-on-year, as the video above ["The Power of One"] illustrates clearly. So unless sales turn around or at least stop falling, where's Plan B when there are no most costs to cut? This is when the short-sightedness of relying solely on cost reduction for profitability quickly turns from a solution to a recurring nightmare. It's awfully difficult to save your way to growth.

There are a host of other risks associated with cost cutting, and most of them are well summarised in this article published a few years ago in Forbes magazine.

A lower cost, lower risk, more effective alternative to wholesale cost-cutting.

The good news is that all that additional downstream, knock-on risk - is unnecessary. Which isn't to say that you shouldn't vigilantly manage your costs. That's smart business and the key to sustainably maximising profit. What we are saying is that there is a more effective, less costly, less risky way of dramatically improving profitability. And it doesn't involve costs at all.

COST BASE

34%

OR

SALES PRICES

25%

OR

PIPELINE OPTIMISATION

0.5%

All three deliver the same financial outcome, but pipeline optimisation through marginal gains does so at a vastly lower cost and risk to the business.

Assuming 40% gross margin and 10% EBITDA, each of the three options above will double the profitability of a company. If that company were to be currently delivering 5% EBITDA rather than 10%, the effect would be to treble profits. A company making a 10% loss would make a small profit.

In pure commercial terms, all three produce a great result. But, how many companies could lose 34% of their cost bases and survive to tell the tale? How many would have anywhere near that number in available "fat"?

Similarly, how many organisations are lucky enough to compete in markets or be so differentiated that they could increase their sales prices by 25% and not have their market share decimated?

Versus a 0.5% improvement in the conversion effectiveness of the sales pipeline?? As the saying goes, "You do the math."